Cota St. Investment Methodology

Focusing on maximizing employee outcomes leads to a different investing approach.

The Dangers of Focusing Solely on Returns

What is the impact of volatility on investment outcomes?

The example to the right represents a $100,000 initial investment in three different investments over three years. While the average return for all three scenarios is the same, increasing volatility impacts the investment's cumulative return and end balance of the account.

Additionally, volatility can lead investors to emotional responses, such as buying high and selling low, causing them to miss out on market rebounds.

Chart is intended for illustrative purposes only and does not reflect the performance of any particular investment vehicle.

Investment Scoring Methodology

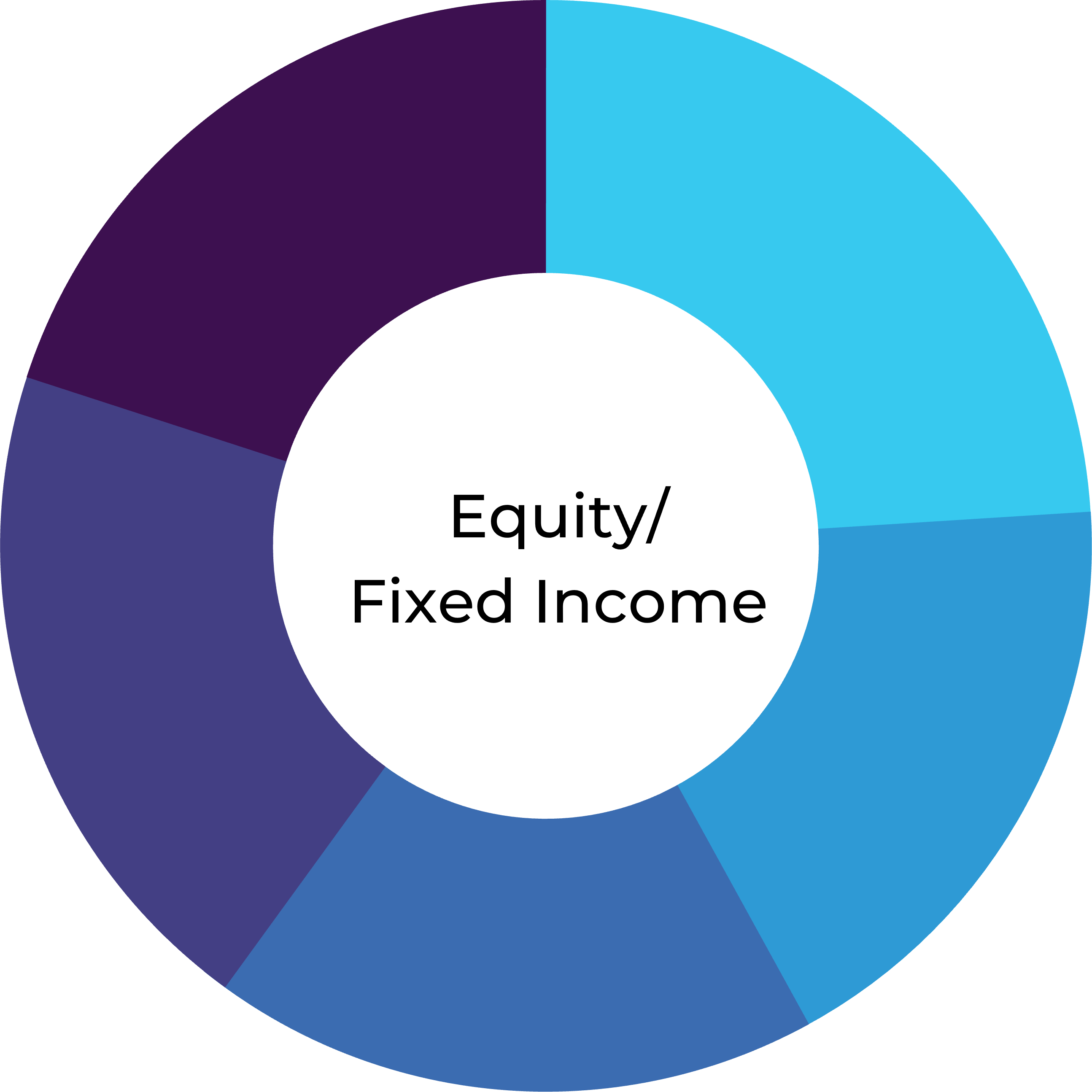

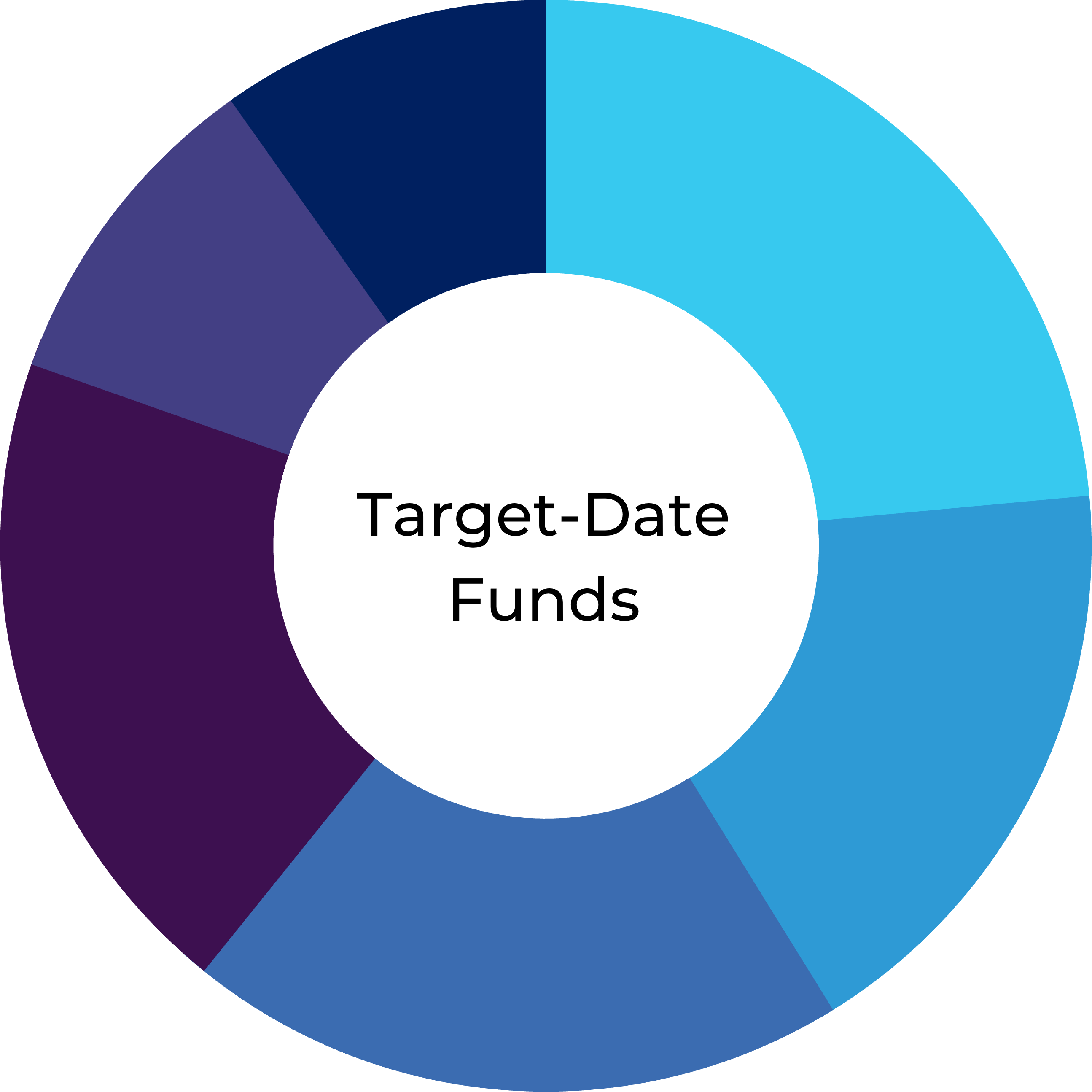

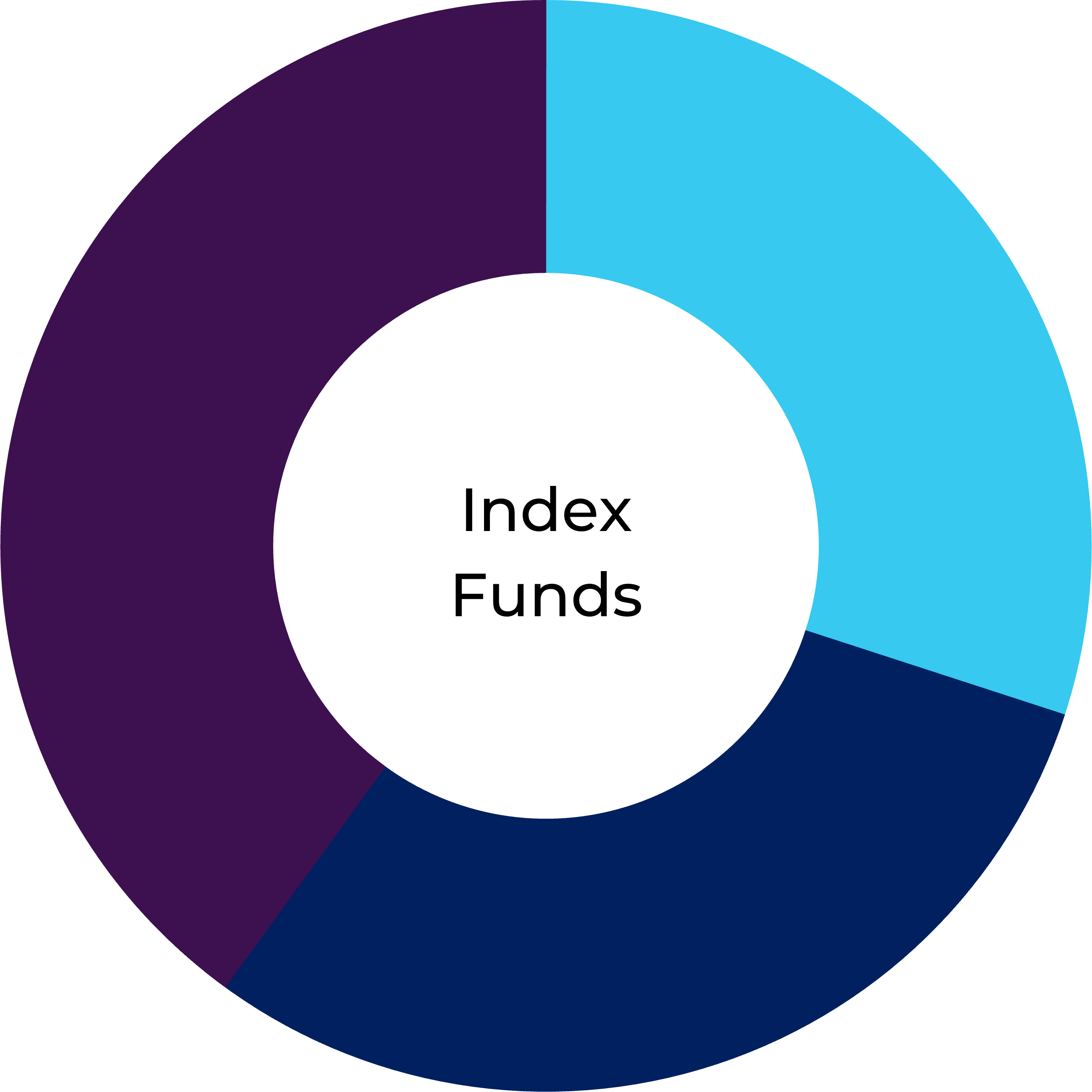

We analyze asset classes differently with a scaled scoring system. Each criteria is scored relative to its quartile performance against its specific benchmarks and peer groups. From there, we can determine whether the funds are deemed passing, put on watch, or flagged for replacement.

■ 24% Performance

■ 18% Absolute Risk/Return

■ 18% Relative Risk/Return

■ 20% Style & Market Capture

■ 20% Qualitative Analysis

■ 24% Performance

■ 18% Absolute Risk/Return

■ 20% Relative Risk/Return

■ 20% Qualitative Analysis

■10% Market Capture

■10% Risk

■ 30% Performance

■ 30% Risk

■ 40% Qualitative Analysis

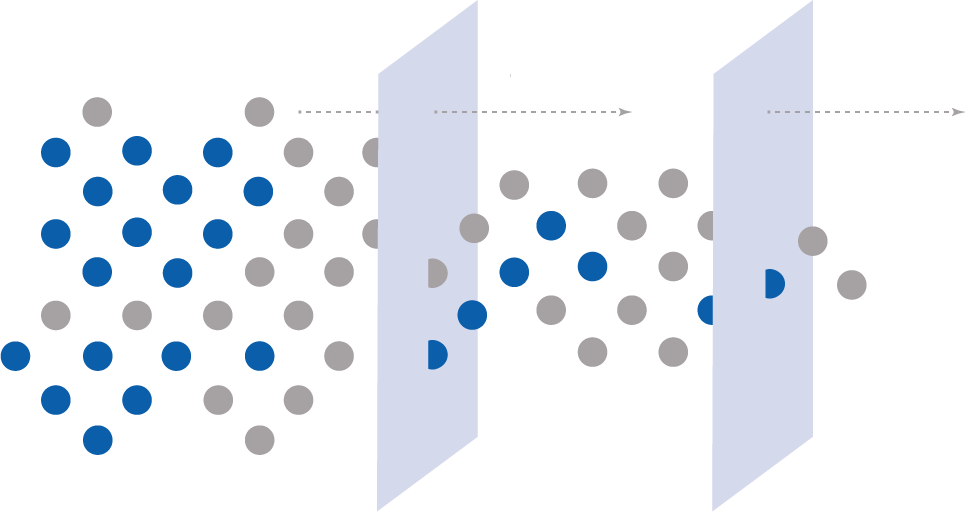

Investment Selection Process

Marrying our custom criteria and analytics, our analysts apply a qualitative screen to help determine investments we feel have the highest probability of success.

Criteria Screen: The fund universe is reviewed to screen the vast majority of undesirable investment options.

Qualitative Review: Our analysts go beyond the numbers to review qualitative factors that may impact the probability of investment success.

Final Analysis: Final selection of each investment is determined based on the quantitative, qualitative, and cost impact data.