Retirement Plan Investment Services

Every service we provide is tailored to your needs.

Cota St. Fiduciary Investment Services

Select the service model that works best for you and your plan.

Cota St. will act as a fiduciary as it relates to the investment services provided to your plan, which means we commit to providing guidance and advice solely in the best interest of plan participants and beneficiaries. Leverage our 3(21) service co-fiduciary liability model, or offload many of those responsibilities to help mitigate your risk by engaging us through our 3(38) service model.

ERISA 3(21)

Investment Advisor

.png)

ERISA 3(38)

Investment Manager

.png)

Represents Plan Sponsor Engagement in Investment Monitoring & Selection

Cota St. Portfolio Advisory Services

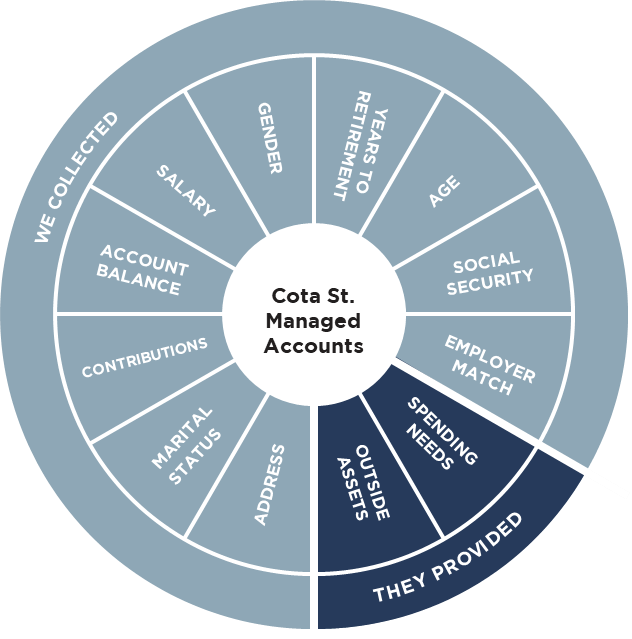

Portfolio Advisory Services is a financial planning service that can provide employees with tailored savings and investing advice to help them reach their retirement goals. The service uses personal data to help employees decide how much to save, when to retire and start collecting Social Security, and build custom Managed Portfolios.

Personalized Managed Portfolios

With more complex data inputs and the ability to collect more data on an automated basis, we can offer personalized portfolios that may create advantages over typical Target and Risk-based models.

In partnership with Morningstar®, our Managed Account Program offers customized retirement strategies for each participant. You can provide employees with access to personalized, professionally managed portfolios designed to help them stay on track to meet their goals.

Investment Analysis & Reporting

- Generated quarterly

- Investment scoring and recommendations or selections

- Portfolio creation

- Lineup optimization

- Investment Mapping

- Cost Analysis

Target-Date Analysis and Reporting

- Suitability Analysis

- Glidepath methodology and philosophy

- Underlying holdings/diversification analysis

- Performance and expense review

Stable Value Analysis and Reporting

- Stable value fund comparison

- Wrap provider and subadvisor details

- Historical crediting rates

- Historical market-to-book ratios

- Performance analysis

- Termination Provisions

Qualitative Manager Research Reporting

- Qualitative review

- Investment strategy

- Portfolio construction process

- Risk control analysis

- Portfolio manager and analysis compensation structure